In the middle of global store lockdowns, 100+ lifestyle brands announce the opening of new flagship stores.

Versace, Puma, Under Armor, Gucci, Saint Laurent, Montblanc, Adidas, Lacoste, Dior, Hermes, Supreme and more report new flagship store openings. All that adds up to retail investments of US$ 200m (assuming standard buildout cost and store sizes) in a time when the internet is booming.

And those are only the openings of the last three months with more in preparation. That is one of the findings we take away from our industry dialogues about The Future in Brand Distribution: More own flagship stores, because of online and because of Covid-19.

But why is that? What is driving this trend? What will the future of flagships be, and where to get the best overview of the latest flagships?

Understanding the Concept of Flagship Stores

Brand flagships in their modern form probably exist since end of the 19th century, with the Steinway Hall in New York being one of the most outstanding examples.

The 2nd generation of Steinway’s Piano Hall, built 1925 (Photo: Steinway New York)

In the post World War II lifestyle market, luxury fashion brands in Paris set the standards with their Haute Couture Salons. Fashion designers showed and sold premium priced products in a salon environment.

Premium and midmarket brands caught on to concept of flagship store retailing around the 1980s. Niketowns (est. 1990) may be the most remembered stores of this area.

By the beginning of this century all premium brands likely had some kind of flagship. Today, the term flagship is used very widely and often describes not more than a larger (than normal) store. In the following strategy review I focus on the store formats that are more than ‘just large’ and do a great job of balancing strong branding with a strong commercial performance.

The Role of Flagship Shops Today

There are many examples of best practice brand retail. One brand with a strong track record of best practices is Apple. Steve Jobs is rumoured to have worked on Apple’s retail flagship concept for many years. It looks like he did a great job and he certainly left a strong legacy. In 2016, we witnessed the latest generation of Apple stores: Apple Town Squares represent the lastest in flagship retailing, the era of community flagship stores.

Apple’s iconic Town Square in Los Angeles, established 2016 (Photo: Apple)

Brands such as Rapha or Lululemon have also given us great examples of community retail, but Apple certainly leads in balancing brand experience with store productivity (sale/sqm).

But Why Do Brands Continue to Invest in Retail When Online is Booming?

Like in other markets, e-commerce is growing in the lifestyle industry too. But even the most progressive online scenarios assume that brick and mortar will still make for more than 50% of the brand market in 2030. With Covid-19 and struggling multi-brand retailers, overstock was sold to third parties and reappeared in online marketplaces with large discounts. Brands had little influence but realised that to prevent this, they need to take stronger control in direct-to-consumer distribution. Nike was just one brand to cut ties to multibrand retailers post-Covid.

In essence, all brand organisations learned over the past 18 months that third party wholesale distribution (online and retail) is a volatile channel. Brands that can afford it grow their own direct-to-consumer channels with a stronger own e.shop appearance, with an own app and own retail flagships.

Moncler also made clear commitments towards DTC, like with this flagship in Paris (Photo: Moncler)

The Future of Brand Retail is Top Cities

How a brand will grow its own retail distribution will vary. And many retail managers still keep their head low on the details of future expansion. But a strong brand appearance in regional and global retail capitals is not in question. Those cities are retail competitive, and that is why more investment needs to go into building unique store experiences.

Rimowa grew via wholesale distribution. With the acquisition by LVMH the strategy changed towards DTC and flagship retailing, here the first Tokyo flagship (photo Rimowa/Daici Ano)

Mission: If you want to be a ‘top of mind’ brand, you have to be successful where global opinions are formed and sales and branding impacts are bigger than elsewhere. If you make it in New York, Shanghai, London, or Tokyo, you can make it anywhere.

And while the post-Covid retail world has changed in parts, affluent consumers will return to tourism and shopping in regional and global retail capitals. And when tourists travel, they include shopping tours in their planning.

Nike’s newest House of Innovation in Paris, a well-balanced mix of branding and sales (Photo: Nike)

With all this focus on brick and mortar retail, online should not go ignored. Omni-channel is a pre-requisite for any store. But technology, brand storytelling, entertainment and selling have to be balanced to create a commercially successful brand flagship.

Planning Flagship Retail: A Balance of Branding and Commerce

I love the strategic complexity of flagship retailing – at the nexus of showroom, entertainment and retail – focussing on brand experience and sales at the same time.

Samsung 837, New York: Showroom or Flagship retail? Clearly an excellent brand appearance, strong entertainment with community elements. But low in commercial retail content (Photo: Brand Pilots)

Where showrooms aim for a top brand appearance, stores must deliver EBIT and retail flagships should achieve both. And that takes some smart balancing, already at the stage of store development planning. Overstate the focus on branding, technology or entertainment and your risk the store’s future productivity.

When planning a flagship project, also consider conflicting agendas: on the one hand, Product Development’s ambition to demonstrate full product competence, and on the other, Retail wanting to offer bestsellers only.

Rarely, flagship stores are taken off the regular retail reporting. The smarter option, however, is to develop a specific flagship reporting that delivers commercial performance as well as branding KPIs (i.e. media reach, NPS).

Valentino’s latest flagship on New York’s Fifth Avenue, clearly centring sales (Photo: Valentino)

The Future in Flagship Stores is Experience. Again.

If you were involved in brand store development over the past decades, you have seen store trends coming and going. Brands with the need to demonstrate that they have arrived in the digital age loaded their stores with tech. Brands already strong on omnichannel performance, freed retail space for community activities instead.

Lululemon’s yoga classes, a best practice to build brand loyalty (Photo: Dalziel & Pow)

But regardless of where you are in store development, in the end everything needs to be measured in sales and brand experience.

Not that experience is a new priority, but the quality of consumer experience has become very transparent. Where in the past it took mystery shopping surveys, exit interviews or NPS questions, these days the growth of Google store reviews or Facebook community likes tell everyone whether the new flagship is worth a visit. And that’s in many ways more telling than the store’s monthly EBIT report.

Swarovski is closing a number stores around the globe, while remodelling flagship stores, here Paris, are a priority (Photo: Swarovski)

It doesn’t take much to forecast that with all this at our fingertips and a stronger focus on flagship retail investments, one day CFOs will be reviewing the NPS development and community growth. So better secure both, qualitative and commercial growth when planning your next flagship.

My Favourite Place for Next Generation Brand Retail

An article about the future in brand flagships can’t be closed without sharing new state-of-the-art stores. But rather than providing our latest list that will be outdated in few weeks, I recommend a quality source to follow: Superfuture.

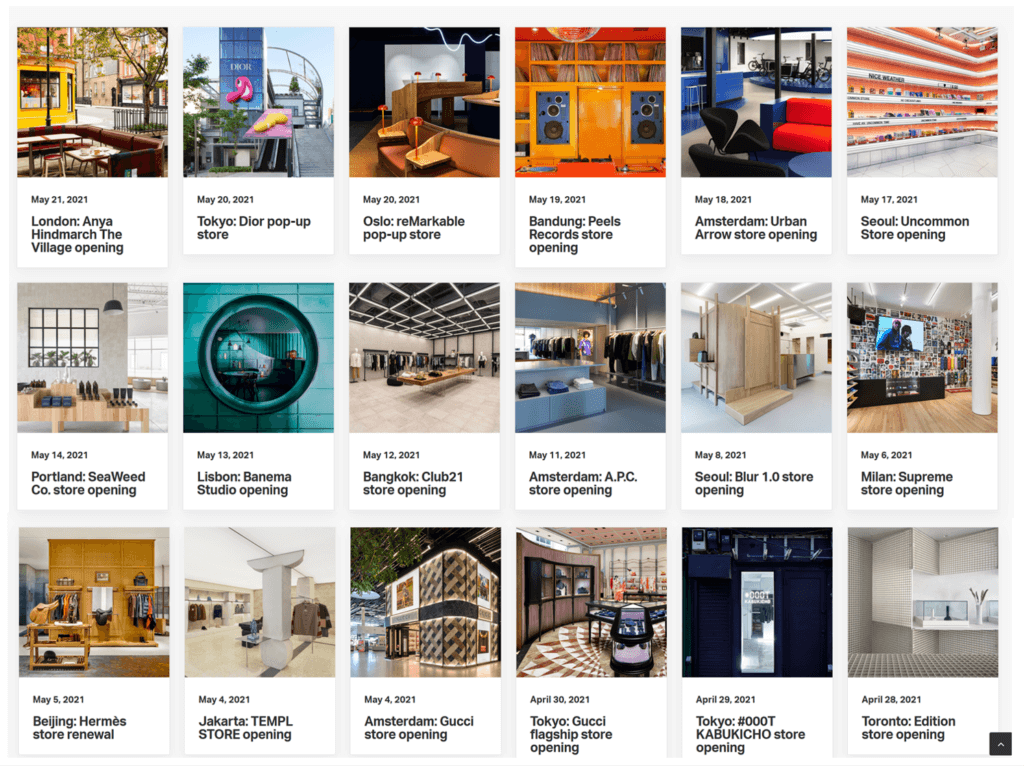

When your international retail travel is paused, Superfuture keeps you up to date on the latest in flagship retail (Source: superfuture)

‘Top flagship lists’, ‘retail city guides’ or ‘best-of rankings’ come and go, this one has been around for more than 20 years and grows better every year. The Superfuture team around Wayne and Andreas does an excellent job to update almost daily. Because the future of brand distribution will have a strong direct-to-consumer focus, with online and brand flagship retailing.

About the Author:

Guido is a brand strategy advisor deeply ingrained with the belief that brand distribution has to be healthy and well-balanced. To discuss the future of your flagships or share your thoughts, get in touch with him via LinkedIn.