Digital

Buzzword Check: Metaverse, NFTs, Digital Fashion and Web3

Are you hyped by the buzz around Metaverse or are you a little sceptical? Digital expert Stefan Wenzel has a clear view on why we should neither bury our head in the sand nor fly too close to the sun in this third version of the web.

How to Sell on Online Marketplaces

Do you struggle finding growth avenues for your brand? Here’s the most important how-tos to help your brand succeed on marketplaces!

Why Store-nostalgia Won’t Suffice: 7 Changes in the Retail Landscape You Don’t Want to Miss in Your Upcoming Strategy Iterations

This article offers seven thought-provoking impulses on how to navigate the post-Covid retail landscape. Spoiler alert: You will need to get your online strategy up to scratch!

D2C: It’s All About Tech

Part two of our D2C series: Software tools bring your D2C strategy to life. Learn which ones are key to consider in this overview.

D2C: It’s All About Consumer Focus

Direct-to-consumer (D2C) is about mastering technology to give the best possible products and services to your consumers. Brands like Nespresso, Tupperware, Tesla or Peloton show how it’s done.

Initiative Retail Future ‘Zukunft Handel’

An introduction to the services and tools that ‘Zukunft Handel’ (Retail Future), an initiative launched by Google and the German Retail Federation (HDE), offers to support smaller German retailers in digitising their business.

Zalando Connected Retail: High Street Powerhouses vs. Online Giants

A long time ago in a galaxy far, far away… (retail) humans and many species of (online) aliens co-exist with robots who assist their routines. Travelling between planets takes place offline as well as online. The same goes for shopping, where retail spacecrafts range from small starfighters called mom & pop shops to battle stations such as the moon-sized Death Star (called Zalando). (more…)

Brand Distribution Best Practice Post Covid

Our research and industry dialogue ‘Future in Brand Distribution’ has been off to an enlightening start. Four weeks in, executive talks and our online survey have already returned much valuable inspiration on the future of the lifestyle industry.

The sentiment we encountered in the industry dialogues was generally positive and energising, even though many still find themselves in lockdowns. It seems as though the Covid-19 pandemic not only gave a boost to digital transformation but also liberated some of the brand industry’s best creative thinking.

The Future in Brand Distribution – in Search of a 1000 Minds

How are these snapshots for a future in brand distribution?

“2025 retail rents will be like 2020 flight routes: back to the 1980s.” “The future is social commerce, digital market places are an interim hype, for brand industry’s e-com latecomers.” “In five years, an office workspace and business travel will be recruiting incentives.” “Grandpa tells me, his company used to pay him for sourcing travel to adventurous rural locations.”

Mind the knowledge gap in marketplace business

In a growing market, a detailed understanding of marketplace business is still rare. Here’s how to arm yourself with marketplace knowledge for success

During the first half of 2020, Zalando onboarded 180 new partners onto their marketplace. At the same time the GMV of their partner program increased 100% compared to the previous year.

Live Streaming E-Commerce: Best Practice Post-Covid Retail in China

To Western ears, TV home shopping may be reminiscent of dull and dated products marketed to mostly elderly consumers. But in China live streaming e-commerce has now become the hottest post-Covid retail trend.

It attracts a young audience, and most successful hosts are brand and retail CEOs.

Digitalisation Is the Face Mask of Your Physical Retail Business

Introduce digital business processes in your retail stores to cope with the negative effects of Covid-19 on footfall. Continue reading for a few best practice examples!

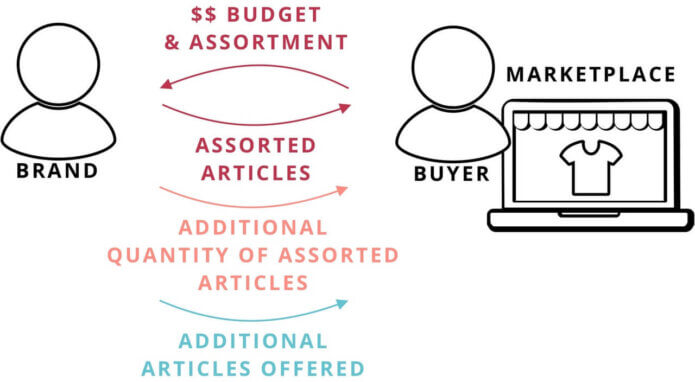

Ecom Real Talk: 4 Ways Brands Can Benefit from Marketplace and Wholesale Business

Marketplace and wholesale business benefit from each other. Choose from four ways to overcome your budget limitations and become your own selling hero.

Ecom Real Talk: A Deep Dive on Marketplaces for Fashion

Selling on marketplaces is no longer an ‘if’ question, but has become about ‘when and how’. A deep dive into the structure of online marketplaces for fashion.

“We don’t want to sell online because we want to protect our brick & mortar stores.”

eCommerce Photography: A Picture Is Worth a 1000 Words

With the rise of eCommerce, the importance of visual media has increased. Some best practices for successful eCommerce photography.

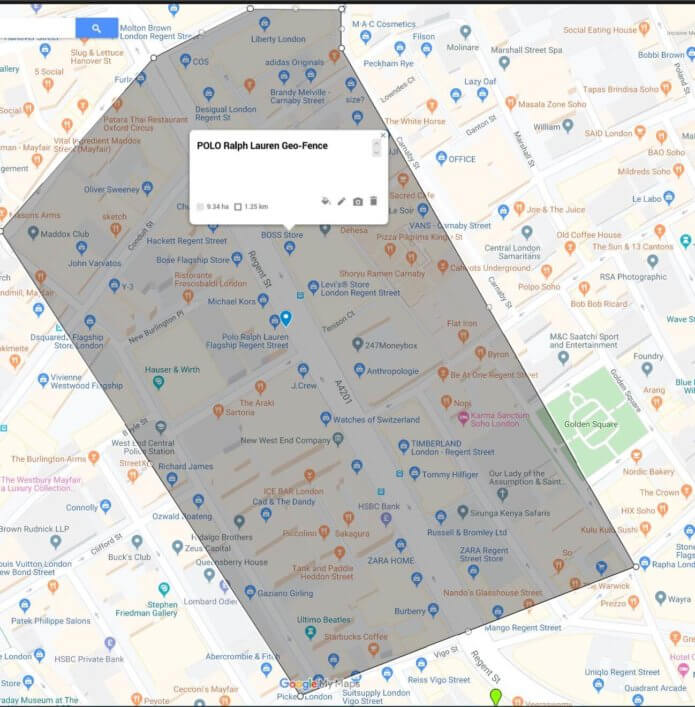

Omnichannel Loyalty: How to Use Geo-fencing to Drive In-store Traffic from App Users

Online and offline channels are merging. Here are some real-world examples of brands driving in-store traffic by sending geo-fencing promotions to app users, requiring almost no investment

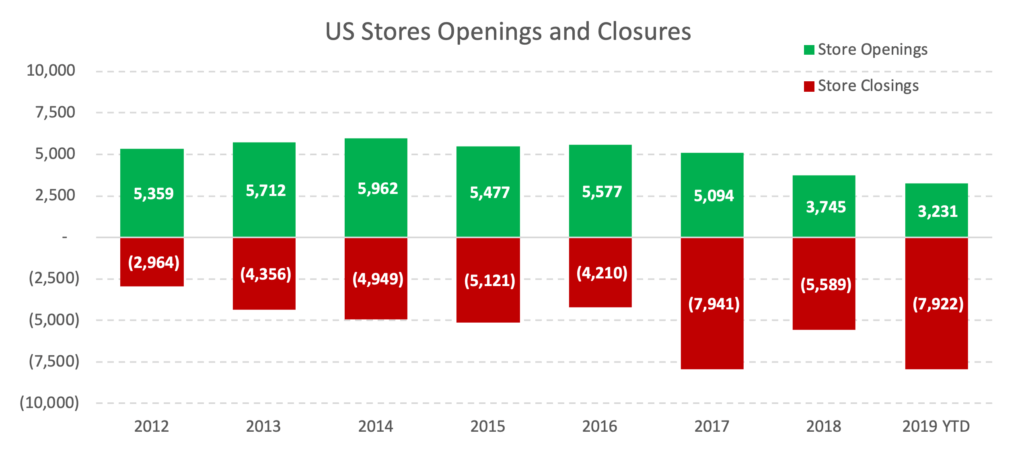

How US Brick & Mortar Stores Can Survive in the Digital Age

Brick and mortar in the digital age: learn how Nike, Recreational Equipment Inc and other leading retailers thrive despite the ongoing retail shakeout in the United States.

Numerous articles over the past few years have discussed the retail apocalypse occurring across the United States. Already this year, almost 8,000 stores have announced that they will be closing their doors with projections to reach 12,000 doors by year end. This will amount to the single largest net loss of retail stores over the past eight years.

- (Source: CoreSight)

Despite many prognosticators promoting the end of the brick and mortar store, there are multiple examples of brands who are leveraging their physical and digital footprints to establish deeper, more meaningful relationships with their customers. However, before we dive into the future, it’s important to examine the key lessons from the past.

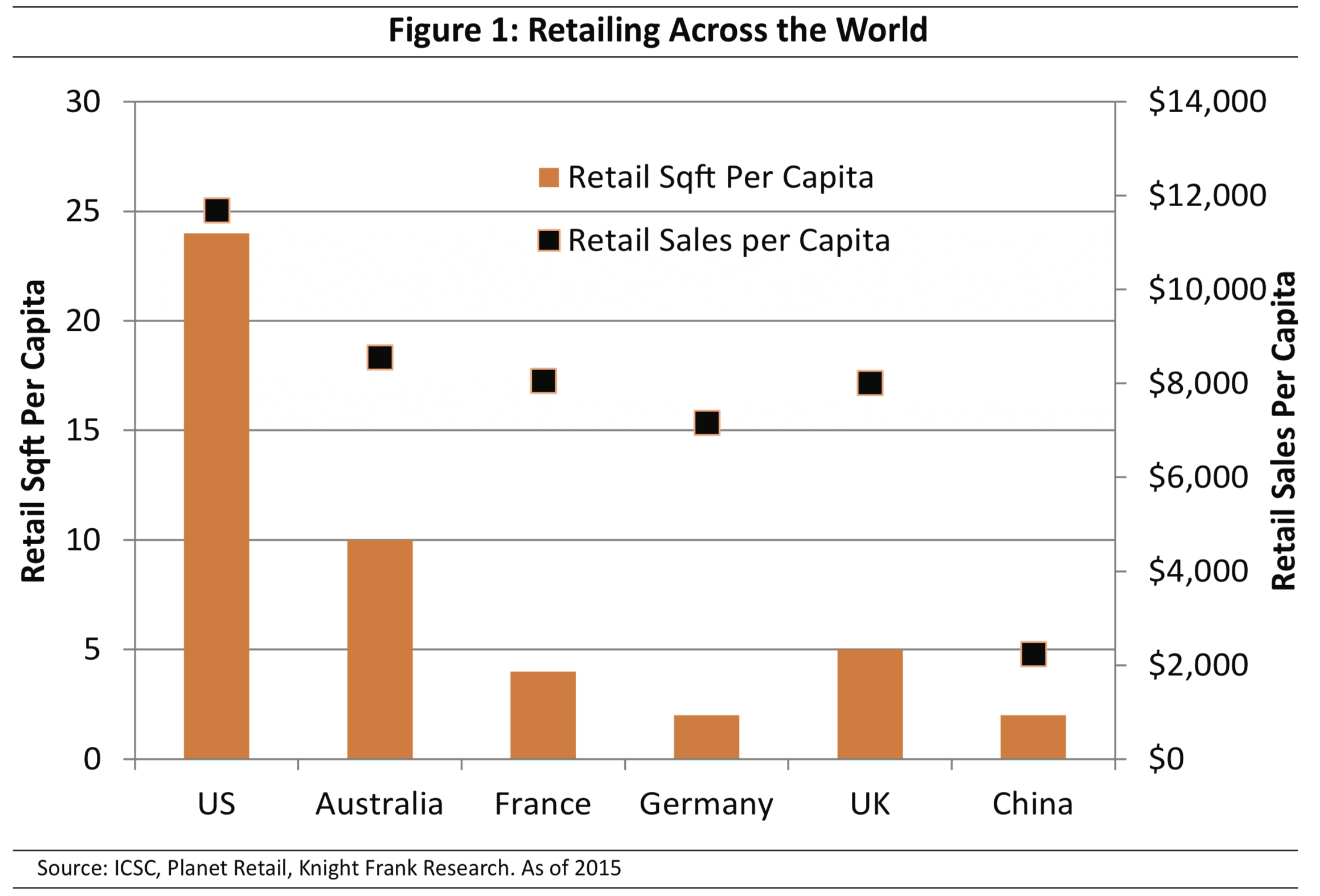

Oversupply + Little Differentiation = ‘Sea of Sameness’

Moving back to the United States after living in Europe for a few years, I was struck by how similar each shopping center looked, no matter what part of the country I was in. The sheer size of the US, access to cheap capital, and a heavy reliance on the automobile fueled a massive expansion of retail stores. Retailers could largely drive annual revenue increases by simply opening up more and more doors. As of 2015, there was five times more total retail space per capita than in France or the UK but only 50% higher sales per capita.

- (Chart: Chilton Capital Management)

The rise of e-commerce, which has reached 35% of all US apparel sales last year, has only accelerated the inevitable demise of many venerable retailers such as Kmart, Toys’R’Us and Payless Shoe Source. An increasing number of doors were competing for the same customers with nearly the same product offering and in-store experience. This resulted in a ‘sea of sameness’.

The Future of Brick and Mortar in the Digital Age

Rather than viewing their stores as a dinosaur, successful retailers are transforming their physical locations to create a deeper, more tactile experience than online-only shopping can. Since omnichannel customers purchase twice as often and spend more than single-channel customers, retailers will need to adopt three basics principles to ultimately survive in the US marketplace.

Create Digitally Connected Journeys

US retailers are investing millions of dollars annually to enable greater omnichannel integration, yet there remains a long way to go. According to L2’s recent omnichannel report, just over 25% of US retailers offer BOPIS (Buy online, pick up in store) and just over one-third provide ship from store capability.

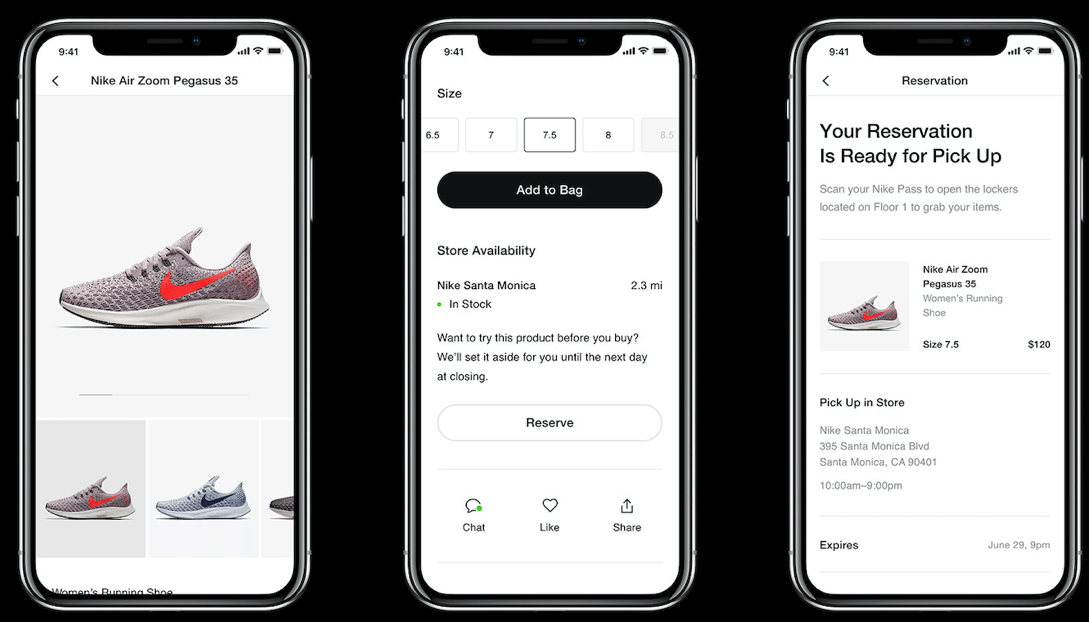

Nike’s new Innovation House in Shanghai and New York, for example, has heavily embedded digital in-store technology to provide consumers greater choice and ease in their shopping journey. Using the Nike app, consumers are able to ‘Shop the Look’, which places a mannequin’s entire outfit in a virtual shopping cart. ‘Scan to Try’ allows the consumer to send items to a fitting room of the their choice. ‘Instant Checkout’ speeds up the payment process by allowing consumers to skip the line and buy their items through the Nike app.

- (Photo: Nike)

Evolve from Selling Products to Selling Experiences

It’s not just millennials who are placing greater emphasis on experiences. Research shows that almost 75% of all Americans surveyed prioritise experience over products or things. While this might threaten many traditional retailers, some brands are expanding their offering to meet consumers where they are and, ultimately, create a deeper relationship.

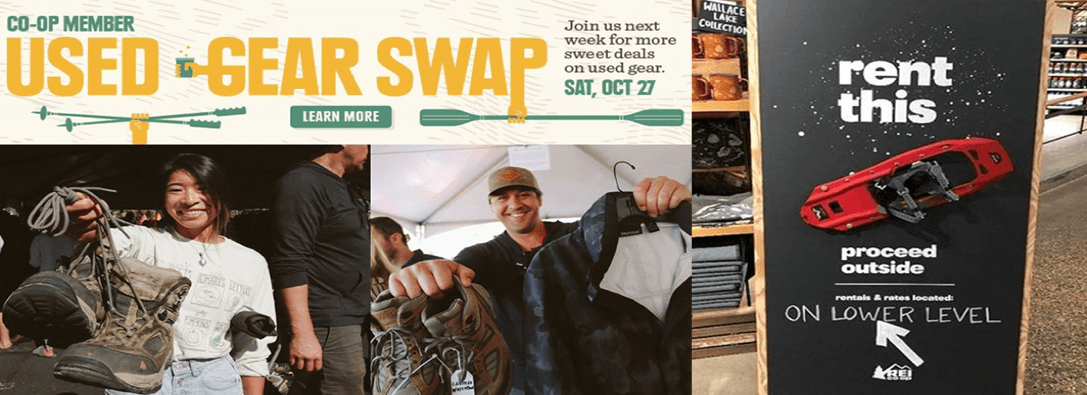

Recreational Equipment Inc (REI), the largest outdoor retailer and cooperative in the US, is aggressively expanding its rental offering and used gear options. Knowing that consumers may feel intimidated about venturing into the outdoors, REI “sees the expanded rental and used gear program as keeping us moving towards a sustainable and accessible outdoor future by offering a new model of access to great outdoor gear and apparel,” says Ben Steele, Chief Customer Officer at REI.

Each rental occasion also offers REI two additional consumer touchpoints, one upon pick-up and another when returning the gear. And each touchpoint gives REI the opportunity to not only sell additional products but also share its knowledge and passion for the outdoors.

- (Source: REI)

Evolve the Sales Associate to a Service Partner

In an age where consumers have so many choices to spend their hard-earned money, the days of the inattentive or pushy salesperson are coming to an end. Despite consumers’ reliance on smartphones through their shopping journey, there remains a need and a potential source of differentiation for stores to provide the compelling service.

In Nike’s Innovation House, the new Expert Studio is Nike’s first dedicated floor to provide member-only experiences such as one-to-one appointments, access to exclusive products and the option to create personalised products in the Nike By You Studio. Most luxury brands already offer an elevated level of service due to their high price points. Nike is providing a similar high-touch consumer experience, and with the Nike app a segmented product strategy and in-store experience to keep the most valuable customers in the Nike DTC ecosystem.

Not all brands in the crowded and competitive US marketplace will be able to make this transition and ultimately not all will survive. While some past market leaders, like Sears and Toys’R’Us, have not been able to pivot their business model, this does not mean that brick and mortar retail is dead in the US. Strengthening omnichannel integration and creating experiences that are meaningful to their most valuable customers are critical steps for all retailers to consider as they try to thrive in a very competitive and tumultuous marketplace in the United States.

About the Author:

With 25+ years in the sports and fashion industry across the United States, Europe and Asia, John Ensminger, has worked with leading brands including Nike, The North Face, K2 Sports and Carhartt to develop breakthrough, actionable strategies that strengthen their brand position and drive growth and profitability. Read his posts here or connect with him on LinkedIn to further discuss brick and mortar in the digital age.

Omnichannel Best Practice at Scale

How do you achieve loyalty card identification in 80% of all purchases and 2x higher spend of omnichannel versus retail only customers?

In this article we explore the ecosystem and customer journey touchpoints that enable Dutch grocer Albert Heijn to meet customer demand and drive omnichannel spend. With 1000 stores and >100k online orders per week, this is true omnichannel best practice at scale.