In the competitive sporting goods industry, not many brands succeed in reaching the top, but Lululemon and Under Armour have. We outline how they created brand growth and whether they have the potential to stay on top.

Over the last couple of years some sporting goods brands have managed to gain visibility and market share and two of them – Lululemon and Under Armour – have shown an outstanding brand growth development.

Under Armour vs Lululemon (Graphic: Brand Pilots)

The Modern Version of Barbie and Ken

At the core of Lulu’s brand DNA is yoga and living a good life. With that image, Lululemon quickly became a beloved brand, attracting very loyal followers that love to feel healthy, comfortable and free, whilst also offering an ethical and high quality product. Lululemon is considered more or less as a female brand. Without a lot of advertising spend, Lulu’s success comes from word-of-mouth and brand experience. The company builds brand growth through its ambassador program and also leverages its presence strongly through social media, in-store community boards and other grassroots initiatives.

Lululemon creates brand growth mainly via onw store, her New York City (Photo: Brand Pilots)

Under Armour evolved with an image of relentlessly overcoming obstacles and becoming winners on the field. The brand evolved from their underdog image, being hungry, competing against the best – and winning. In contrast to Lululemon, Under Armour’s marketing is loud and pushy: therefore it’s considered a more masculine brand. “I will” is a constant message and with this, Under Armour generated brand growth systematically via new categories and markets. It’s ethos fits perfectly in the new US environment.

Under Armour Brand Store, Hong Kong (Photo: Brand Pilots)

The popularity of these brands is strong, with both seeming to be clear winners in the US market. Google Trends reports far stronger search interest in Under Amour globally and for the USA. But when looking at the difference by US States, there occurs another interesting pattern in terms of search ratio for the two brands.

We don’t want to elaborate on Trump vs. Clinton, but we guess that with the last presidential election, everybody has learned there is not one perspective and not one American. Like Clinton and Trump, Lululemon and Under Armour both generate brand growth with very different target groups.

Growing Healthy or Being Aggressive?

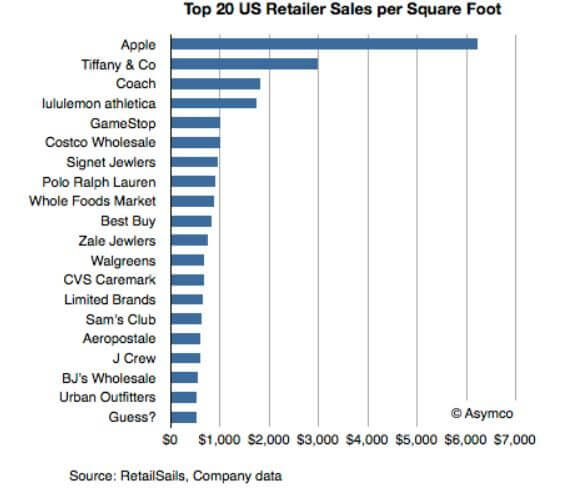

With a 3 year CAGR of 9%, Lululemon grew at a decent rate. With 74% of their sales coming from retail and 19% from online, Lululemon’s business model and growth is clearly directed towards consumer and vertical. The gross profit of 48.4% is not superior for a vertical retailer and dropped over the last 3 years. But Lululemon can afford a lower margin, as their space productivity is likely to be the highest amongst the top 5 sporting goods brands and one of the highest in US retail, according to Asymco.

Top US Retail Space Performance (Graph: Asymco)

On the other side, Lululemon’s revenue is still heavily dependant on North America. With a 3 year CAGR of 27%, Under Armour clearly outperforms Lululemon, Adidas & Nike. Compared to Lululemon, Under Armour benefited from growing with a wholesale focus. That’s less capital intensive, but normally faster and more profitable than retail growth. However, Under Armour’s brand growth strongly depends on North America (83% domestic revenue) as well. So, it’s no surprise that with the recent restructuring of the US sporting goods retail and department stores, the brand struggles to maintain its growth & profit.

Under Armour’s online and retail revenue is around 30% of total revenue. Their retail sales are mainly through their outlet business in North America, but no details have been provided. Unlike Lulumenon, Under Armour doesn’t share store performance KPIs. Even if Under Armour’s sales growth in 2016 was still above 20%, it seems that the brand could get under pressure as the growth is slowing down.

Lululemon FY 2015 Under Armour FY 2016

Founded 1998, Vancouver 1996, Washington

Sales US$ 2.1 m US$ 4.8 m

Share International (excl. NA) 7.0% 17.0%

3 Y CAGR 9.0% 27.4%

Sales Share DTC (Online & Retail) 90+% 31%

Retailing Countries 10 6

Stores 362 241

Retail Space Productivity US$ 15.410/m² n.a.

Gross Profit Margin 48.4% 46.4%

EBIT Margin 17.9% 8.7%

Considering Lululemon has a high revenue share in retail/online with normally larger gross margins, while Under Armour is mainly wholesale, Under Armour is clearly ahead in the gross margin comparison. But that’s clearly different with the EBIT margin: Lululemon has an EBIT that is twice as high as Under Armour.

Perspective Global Brand Growth

With last year’s brand growth, both companies became serious contenders for a top 3 spot in global sporting goods. Both have their struggles and their growth problems however, both Under Armour and Lululemon, still have to prove that they can grow their international business to a meaningful share.

Lululemon Store, Hong Kong (Photo: Brand Pilots)

Lululemon only publishes the details on 2016 in late March, but earlier messages clearly indicate its fiscal 2016 was a success, with brand growth and profit going up. While in brand growth Under Armour looks far more convincing, gross profit margin and profitability indicate much of their sales growth was achieved too aggressively.

With less than 15% derived from international sales, both Lululemon and Under Armour still have many years of untapped global brand growth potential. But more markets means more complexity, more cost and more challenges to maintain health and profitability.

Under Armour is internationally well ahead, not only in revenue but also in brand recognition. However, Lululemon seems to have the more stable and superior business model – their franchise agreement for the Middle East is an indication that the brand envisions future international brand growth, mainly via wholesale; so its profitability could get another boost.

Under Armour Flagship in Abu Dhabi (Photo: Brand Pilots)

Looking at past brand growth and sales volume, Under Armour still seems to be the clear favourite to strengthen its position as the #3 sporting goods brand. However, it remains to be seen, whether Lulu’s balanced qualitative growth is potentially the smarter and healthier way for brand growth. Barbie vs Ken – retail vs wholesale, yoga vs football, balanced vs aggressive brand growth – the competition will remain exciting.

About the Authors

Andreas and Guido met for the first time in 2009, when they assisted the PUMA Board to reshape and balance its brand growth strategy. Andreas is an experienced CFO and regular advisor for boards and investors. Guido is a strategy consultant and interim manager, on sabbatical leave. If you want to contact them you can reach Andreas or Guido best by email.