Let me take you on a deep dive into the challenges and opportunities behind VF’s recent Icebreaker acquisition. What’s in it for the brand, its new owner, and the consumer?

After working in the fashion industry for close to 30 years, you tend to look at brands from a professional angle. This post at the same time represents my very personal perspective for two reasons: I write about my favorite sportswear brand Icebreaker, which, secondly, was acquired by VF, the company I worked for in the early 2000s. This post evaluates the challenges and opportunities for the brand and its new owner and what VF’s Icebreaker acquisition means for brand enthusiasts like me and hopefully lots of new consumers.

For those unfamiliar with the brand: Icebreaker is a New Zealand based sportswear brand whose mission is to revolutionize the sportswear industry by developing highly functional sportswear made from natural fibers, preferably Merino wool.

I have tried a lot of competitors’ woollen products – base layers from Jack Wolfskin, Odlo, Löffler and Falke – and I am still convinced that there is no better and more comfortable product in the market than 100 % merino apparel from Icebreaker.

Icebreaker Ad for a Pop-up-Store in San Francisco (Photo: sfcitizen.com)

What are the challenges?

1. Sourcing of brand DNA-relevant raw material: superfine merino wool

Probably one of the most critical challenges is to find sufficient volume of ethically sourced superfine merino wool to fuel VF’s growth plans. Icebreaker is a pioneer in sourcing ZQ certified merino, which is a certification comparable to the European ‘Responsible Wool Standard’. Both certifications request strict standards of sustainable farming and animal welfare. In 2016, Icebreaker purchased a quarter of New Zealand’s total merino wool production.

Artifical fibers have dominated the sportswear industry for decades. At the same time, the use of wool in the fashion industry has been shrinking. In 2012 the share of wool on global fiber consumption was 2%. And wool prices have been falling following the lower demand. This makes sourcing larger quantities of merino wool sound much easier than it is!

Consumers nowadays are increasingly conscious about products harming the environment and this affects the fashion and sportswear industry as well. Many young entrepreneurs don’t only want to make money but also want to contribute to making this world a better place.

New Zealand Sheep Industry Transformation (Photo:nzmerino.co.nz)

And one of the trends that follow from this is finding alternatives to non-degradable plastic and mineral oil based fibers. Rediscovering the functionalities of natural fibers, in conjunction with new manufacturing techniques, is a source of innovative products that come with a sustainability label attached.

Brands like allbirds or glerups specialize in using the same merino wool quality that Icebreaker needs for its highly functional products. The downside of this trend for Icebreaker is an increasing demand for merino wool and other natural fibers eventually leading to higher prices, especially for superfine merino wool.

This has been a concern of VF prior the Icebreaker acquisition, but one that has already been addressed by Icebreaker by sealing 10-year supply agreements (including pricing) with New Zealand merino farmers. Whether this will prove sufficient for VF’s ambitious growth plans remains to be seen.

Allbirds – Better Shoes in a Better Way (Photo: official website)

2. Finding a design language that works for all markets and differentiates the brand from its competitors

Working with natural fibers, and especially with merino wool, comes with a higher price tag. Merino costs 4 times as much as artificial fibers and 5 times as much as cotton. The product is durable, moisture regulating, odor minimizing, machine washable and long lasting which is precisely what consumers expect from a product with these higher prices. When Icebreaker launched in Germany in 2007, consumers considered the purchase of an Icebreaker product as an investment. And this investment was expected to last much longer than for just one season.

Icebreaker’s design language had to support this concept of long-lasting, durable and sustainable products while still inspiring people to buy new products. Not necessarily because they needed to replace an old one, but because they liked it so much they wanted more.

Selectively following fashion trends and colors but preserving the aura of timeless, high quality, unique and long-lasting products will remain one of the challenges of the brand. Other brands like Odlo, Ortovox, Löffler and Falke are trying to gain chunks of Icebreakers market. Thus, finding a unique design language that helps to differentiate from those competitors becomes a crucial success factor.

Timberland Store (Photo: korserv.de)

Fortunately, VF has demonstrated with Timberlands’ integration into their portfolio that they are capable of shaping, forming and fine-tuning a brand’s DNA to make it more desirable and accessible to a wider range of consumers.

3. A high degree of innovation to keep the competitive advantage

A few years ago, Icebreaker was the only brand offering sportswear made from 100 % merino wool. In the meantime, other brands have discovered the potential too and have launched similar products. The market for innovative, sustainable, highly functional products is growing, but so is the number of competitors trying to gain market share.

Mover is using high density, water-repellent cotton shells for its skiing jackets. Kjus has developed a ‘down’ coat made from silk, and Patagonia has partnered with Yulex to develop cutting-edge materials made from latex-free rubber for wetsuits. Silicon Valley based Modern Meadow is focusing on developing lab-grown leather.

Qmilk (Graphic: Official Website)

Qmilk, a Hannover based company develops a natural, smooth and silky fibre made from waste milk which is biodegradable, antimicrobial, flame-resistant and non-allergenic.

There are a lot of initiatives, especially in the sportswear industry, to launch innovative materials. Preferably ones that come with a story of sustainability and a sense of responsibility. Being in the lead in launching natural products that beat the functionality of traditional sportswear made from artificial materials will be crucial for Icebreaker to keep its competitive advantage. Icebreaker is already working on replacing synthetic and down insulation by merino and has developed a merino based fleece fabric.

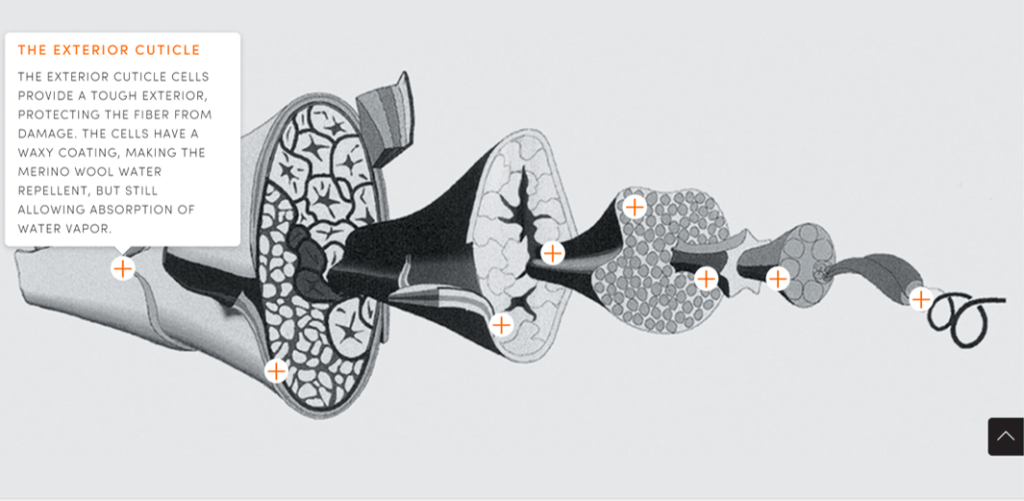

Science of Wool (Graphic: eu.icebreaker.com)

4. Establishing the brand as a full-outfit, all-season, multi-sports fashion brand

Icebreakers’ UVP comes from using merino for sportswear. Jeremy Moon, the former CEO of Icebreaker compares Merino to the hair on our skin.

It’s based on the same molecular makeup. That is why the fabric feels natural. ~Jeremy Moon

Its supersoft, non-itchy, moisture regulating, temperature-controlling and odor minimizing qualities have convinced a lot of buyers and consumers. Pretty quickly, Icebreaker has become the brand that stands for high quality merino base layers.

But Icebreaker is more than a functional underwear brand. Icebreaker offers a full range of products from t-shirts, sweats, zip jackets, hoodies, pants, dresses to outerwear and accessories. The brand opened its first Shop-in-Shop in Germany in 2007, but to this day the majority of retailers buy the brand in its base layer category only, preferably for the winter and skiing season.

Establishing the brand as an all-year-favorite, full-outfit, multi-functional and multi-sports apparel brand with attractive, timeless, high-quality apparel made from durable merino and other natural fibers will be an important growth factor for the brand.

Icebreaker Touch Labs (Graphic: Official Website)

5. Controlling brand performance, presentation and sell-through at POS

The majority of sportswear retailers structure their assortment by sports. They have departments for running, hiking, trekking, camping, cycling, water or winter sports and so on. They make deliberate decisions about which brands to place in which sport’s department, and not very many brands are represented in multiple departments. This poses a dilemma for Icebreaker, as its products can be worn for almost all kind of sport. Retailers, however, are unlikely to invest in presenting the brand in multiple areas of a store. Icebreaker has already begun to develop a D2C- and omni-channel strategy to overcome this bottleneck.

Icebreaker Shop-in-Shop at Globetrotter in Munich (Photo: Heike Blank)

Globetrotter and other sports retailers are already presenting the brand in exclusively designed shop-in-shops, and Icebreaker already opened its first European store in 2008 in Chamonix and has been growing its retail presence since then. Today Icebreaker operates 30 stores called ‘TouchLabs’ and 10 outlets. The financial background and retail partnering experience of VF is an excellent match to support Icebreakers’ growth in the future, in all distribution channels.

What are the opportunities?

1. VF’s proven track record of efficiently integrating new businesses and using supply chain synergies

Integrating new businesses into the VF corporation is an integral part of VF’s business model. Using synergies in supply chain, logistics and management capacities will help Icebreaker to reduce costs in admin, sourcing, production and logistics. This creates the financial freedom for investments into product development and innovation, D2C-expansion, retail partnering and brand development. VF’s icebreaker acquisition may allow the brand to increase margins and/or reduce recommended retail prices should competition force a significant price shift.

2. High level of compatibility with sportswear trends

Icebreaker is in the comfortable position of being the potentially perfect answer to several trends at once:

Sustainability

One of Icebreakers core brand DNA elements. They use natural fibres, partner with ZQ-certified farmers, minimize their CO2-footprint not only in terms of production but also in terms of the lower frequency of washing, no need for ironing, durability and bio-degradability of Icebreaker products.

Multi-functionality

The entire sportswear market is looking for multi-functional apparel: shifting seasons, unpredictable weather, and increasingly conscious consumers who prefer one t-shirt for all sports over 10 different ones for each sport they may or may not try out. Athleisure is a big trend, that is, sportswear that can be worn for active sports but also as day-to-day apparel for a shopping tour or to chill with friends.

And Icebreaker has the perfect product answer, apparel that covers all sports and works for temperatures from + 30 to – 10 degrees, Tees which work as a base layer but also as a mid layer, or indeed the only layer, or zip jackets and hoodies that work as mid layer in winter and top layer in spring, autumn and in-between seasons.

Closer match of collection timing with real seasons and climatic conditions

This is an evergreen problem that the fashion industry has been discussing for decades. Surprisingly, one of the otherwise most innovative segments of the apparel market, the active sportswear industry, is being most resistant to substantial changes in order and delivery rhythms. Reducing time to market, monthly or bi-monthly drops, flash collections to allow retailers to spend open-to-buy budgets based on in-seasonal demand, stronger NOS-programs for fast replenishment and different supply chain models for faster reaction on market trends are success factors for becoming and remaining an interesting partner for sportswear retailers around the globe. With VF as the new owner, this challenge clearly becomes an opportunity.

Conclusion

From a consumer point of view, I am happy that VF decided to buy Icebreaker. I always found it difficult to get access to the full range of Icebreaker products rather than just the base layers. I’m a big fan of sportswear made from natural fibers and believe that this will be the future of the entire industry. I hope that a new strategic point of view with regard to product design will make the product even more attractive, unique and special, not only during winter season. And possibly, end consumer prices will benefit from brand growth and VF-supply chain synergies too.

About the Author:

Heike Blank has worked for big organizations such as VF Europe and s.Oliver but also for niche brands such as Ecko Unltd. and Zoo York in top executive positions. Her extensive experience with opening and managing own retail, partner stores, concessions and shop-in-shops in 23 countries in Europe, the Middle East and Asia make her an expert in expansion. Please feel free to email her to discuss VF’s Icebreaker acquisition and other projects, or read more from her here.