Successful direct-to-consumer (D2C) business requires a consumer focus enabled by the latest technology. Brands like Nike, Adidas, Rimowa, or Snocks show us how it’s done.

Direct-to-Consumer = Consumer Focus

Selling direct-to-consumer (D2C) is nothing new to brands. Brands’ own stores, for example, have been around for decades. So what’s new and what’s different this time around? Why all the hype from brands and investors alike? To me, D2C means nothing more than a consumer focus, but on tech steroids. Driven by the latest technology, brands have more tools than ever at their fingertips to communicate directly with consumers and provide them with the most relevant offer.

2.5 Ways of Selling Direct to Your Customers

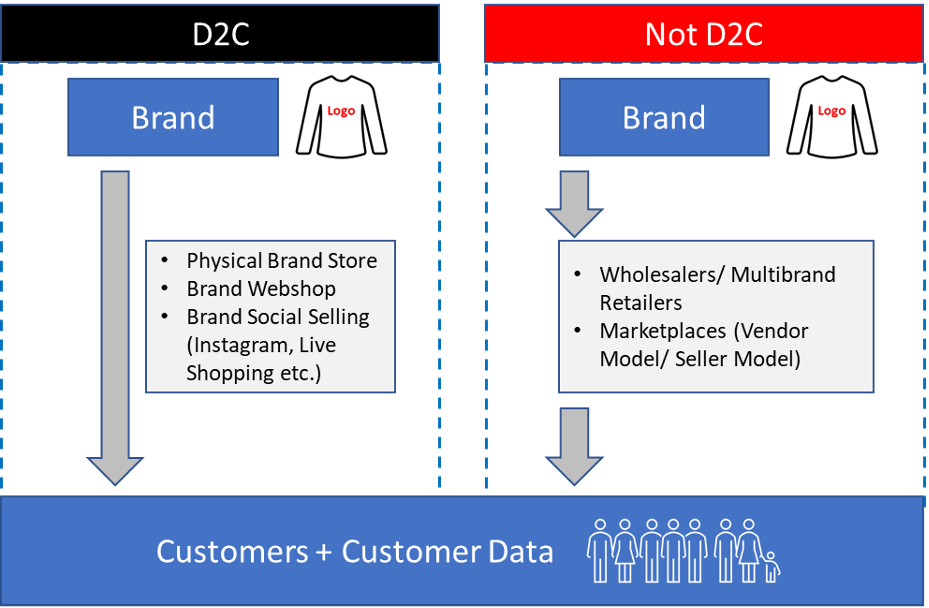

Direct-to-consumer means selling directly to an end consumer. As a result, the seller owns that customers’ transactional data and can use it for their own marketing purposes. Your own online shop, your own brand store, or selling on social media are frequently used direct-to-consumer channels.

Digital marketplaces like Amazon or Zalando, on the other hand, legally own their customer data and therefore are only half of a direct-to-consumer channel for brands. Investing in marketing campaigns on marketplaces may be less efficient than building direct-to-consumer business where you own the customer data and can build a true 1:1 customer relationship.

Despite this lack of consumer data ownership, many native direct-to-consumer brands do very well on marketplaces. Marketplaces combine a detailed knowledge of their target group with an excellent understanding of digital performance marketing processes and tools.

(Source: Berendes Unternehmensberatung 2021)

David, Goliath and the Middleman

Many brands apply direct-to-consumer strategies. There are the Davids, i.e. the small startups with a largely digital-only direct-to-consumer approach. They start out with their own online shop and sometimes add selected marketplaces for additional leverage (e.g. Snocks). They are digitally native, and with their lower brand awareness not yet well-known enough for larger multi-brand retailers. For a long list of smaller direct-to-consumer brands across multiple industries have a look here. On the other end of spectrum are the global brand Goliaths like Nike, Adidas or Rimowa. Their primary motivation for going direct-to-consumer is to regain control over their brand presentation.

These large brands have been operating their own stores for many years and therefore already have an understanding of what it takes to sell D2C. Their focus is to get closer to consumers by leveraging their brand’s power to enforce tighter brand guidelines with wholesale partners.

(Photo: Rimowa/Productmate)

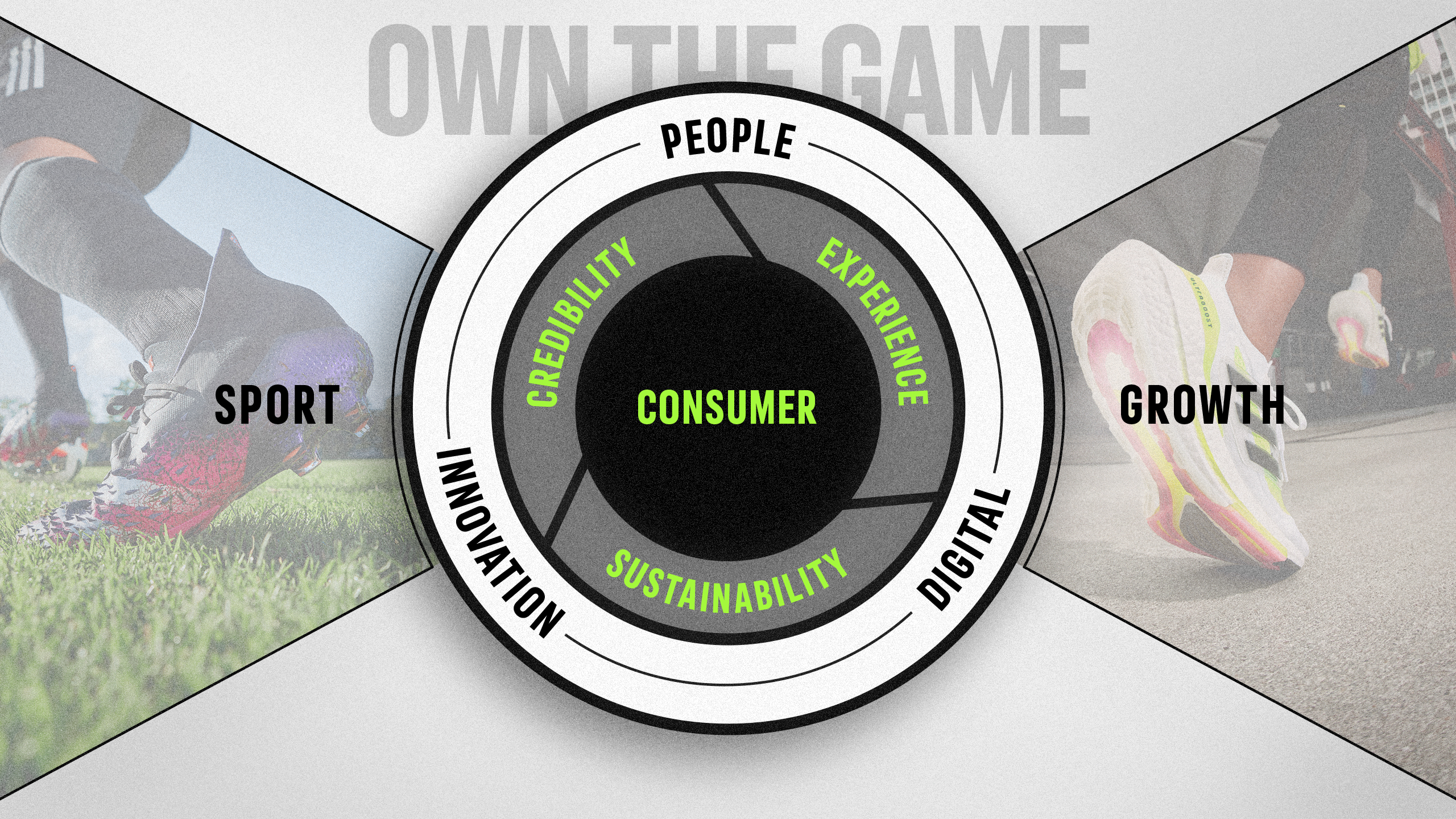

Adidas, as part of its ‘own the game’ strategy, recently announced an increase in pressure on wholesale partners (in German). Key elements of that pressure include higher minimum order volumes and minimum presentation standards. Luxury luggage brand Rimowa started down the same path some years ago, causing an outcry among many of its old retail clients, especially those no longer considered primary brand outlets.

(Source: adidas-group.com)

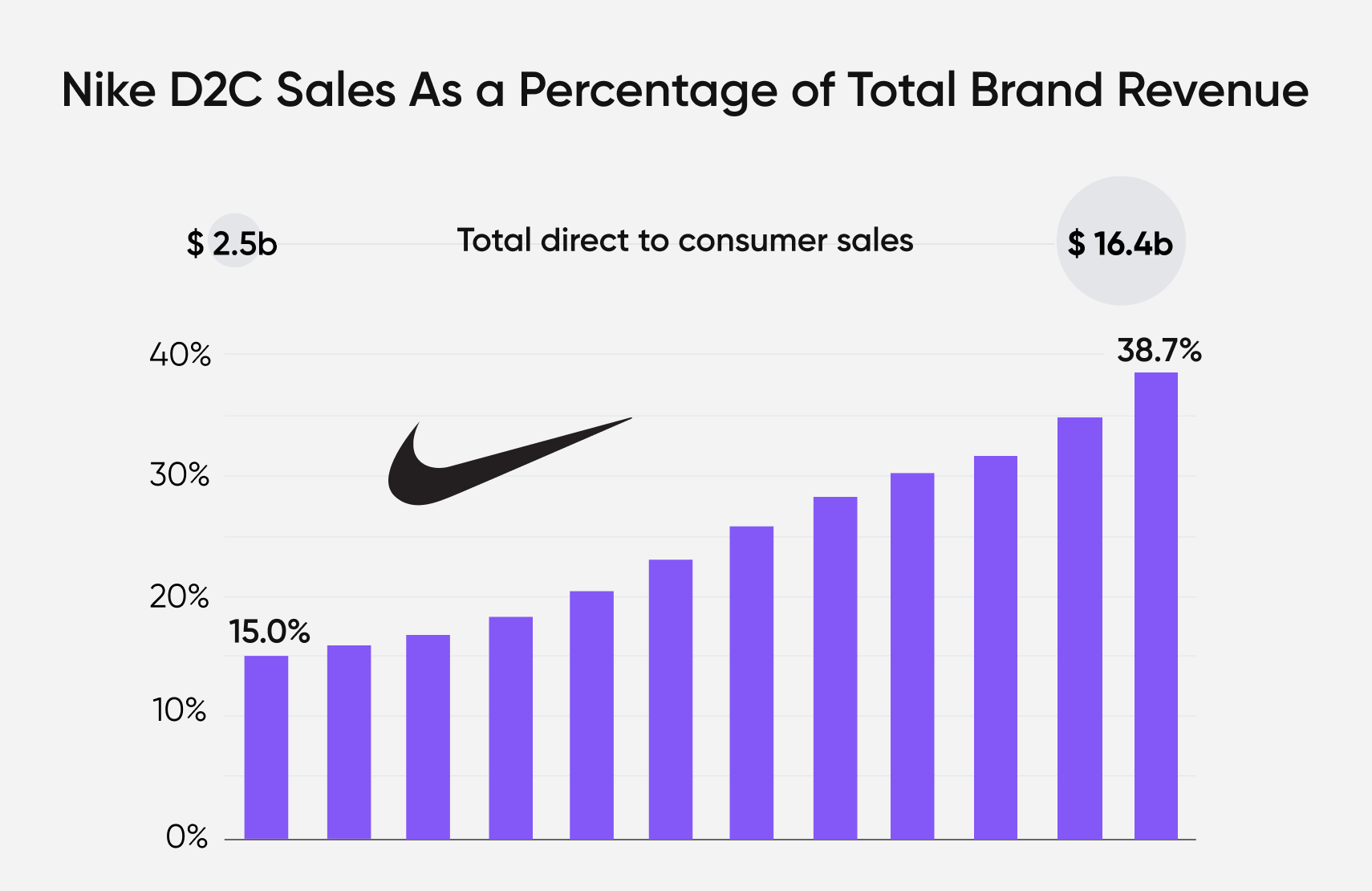

Nike’s ‘Cosnumer Direct Acceleration Strategy’ is showing clear results. In 2021, Nike already generated 38% of its revenue via direct-to-consumer channels. Additionally, they now also focus their wholesale distribution on fewer accounts and/or a reduced product offer as evidenced by their recent announcement to reduce the breadth of product available at Foot Locker.

(Source: fabric.inc)

Traditional Middlemen (aka Retailers) Try to Catch Up

The success of direct-to-consumer business models is undeniable. And traditional retailers/wholesalers are scrambling to open their own marketplace model, testimony to their need to find a way to monetise consumer access if they do not want to be ‘disintermediated’. But now that technology makes working across different parts of the value chain so much easier, is eliminating the middleman and going consumer direct really the only answer?

How about the old adage of ‘efficient consumer response’ and sharing data across the value chain? Isn’t that much smarter than trying to do everything on your own? Take for example VAUND or blaenk, two German retailers who base their business model on giving brands the space and the data they want. Data comes from various sources: transactions, feedback from the shopping app, the loyalty program, and so on. Their ‘retail as a service’ business model revolves around sharing all relevant consumer data with their brand partners.

They also stand out based on their well-curated assortments, focusing on smaller, lesser-known brands. Let’s see whether in the long run they can do better than B8ta, a US pioneer of the ‘retail as a service’ idea. B8ta had to shut down its US operations recently, blaming its demise primarily on the negative effects of the Covid-19 pandemic.

(Photo: Vaund)

How to Succeed: The Direct-to-consumer Virtuous Cycle

Direct-to-consumer business is all about owning the functions and processes traditionally provided by a retailer. From a brand perspective, customer acquisition and customer retention are the two key ones. While this is not new, particularly not to those who run online shops, the sheer number of tools involved in direct-to-consumer business is at least somewhat new. The ubiquity of social media is the main driver, and with it comes a plethora of communication channels, tools to collect/disseminate brand communication, and influencers.

On the most strategic level, there are three critical components of any direct-to-consumer strategy that require the right tools. In a continuous cycle you need to:

- Listen to your consumers,

- Improve your offer based on feedback, and

- Talk to your consumers again to show them your improved offer

- Repeat

Your Direct-to-Consumer Tech Stack: The Basics

Before we dive into some of the specific technological aspects of a direct-to-consumer model, let’s quickly address the basics. The following fundamentals need to be in place to make it work:

- An ERP- and shop system including content management systems (CMS) and product information management (PIM).

- A state of the art customer relationship management (CRM) system

- A data warehouse

- A strong business intelligence team (for analysis and reporting)

Since these have been widely discussed for years, I will not go any deeper here into them here.

Words and Language Matter

It all begins with understanding how your consumers speak and how they search for products, so that you later know how and where to communicate with them. In other words: you need to master SEO. While the SEO world is vast, some of the more obvious tools worth mentioning are:

- Google Search Console / Google Ads: the mother of all SEO tools

- Ahrefs.com: an alternative to Google’s proprietary software

- Answerthepublic.com: Answer the Public provides questions from Google’s autocomplete results (and some other types of searches). This is helpful for generating specific content ideas and an indication of where/how to communicate with your consumers.

Your D2C Tech Stack: Customer Listening & Communication

Customer listening is key. That is, the structured collection and analysis of customer comments via digital or physical channels. Customer listening is about combining and analysing all available information, be that from your own website, your social media channels, or from marketplaces. All that data needs to be collected, aggregated, interpreted, and then used to guide action.

The underlying paradigm shift here is to understand that social proof is now a key element of your brands’ equity.

Consumers are talking about you and your brand everywhere. Whether on marketplaces, your online shop or any other platform for product feedback or recommendations. And there is much to learn about how your offer can be improved. But without a few helpers, the task is just too complex to achieve. Some smart tools for review management are Brandwatch, Gominga and Talkwalker.

Actively asking for feedback, for instance by adding feedback forms to your product packages, is also a smart move that many successful direct-to-consumer brands apply. Lumaland tents (part of Socialchain) has mastered this approach. Based on listening to their consumers and improving their products based on feedback they were able to swiftly take market share from more established players.

(Source: Lumaland)

Digital Store Checks

A very powerful tool for digital store checks is Adapt. It crawls millions of online shops and lets you analyse a ton of data, from on-page positioning of your products to competitor pricing and promotional activities, among many more.

(Source: adapt.online)

You can manage the bulk of outbound communication to consumers via CRM systems like Salesforce, MS Dynamics, or Hubspot. And the social listening tools mentioned above can also play a major role here. With a particular focus on generating social media campaigns, Hootsuite is a widely used tool.

(Source: brandwatch.com)

Your D2C Tech Stack: Testing & Improving Your Products

Once you have listened closely and are ready to test your ideas for improvement, there are tools to help you do just that too.

Digital channels come with the ability to easily test the variables of your offer and how they affect customer preference. A/B testing with tools like VWO lets you test the outcome of anything from design changes on your website to alternative products. And for a slightly more traditional approach to the same idea of product testing, check out market research providers Appinio or Opinionstar.

Your D2C Tech Stack: Integrated Solutions

While all the D2C tools mentioned so far are great point solutions, part of the complexity of managing a direct-to-consumer brand arises from using a plethora of non-integrated software solutions.

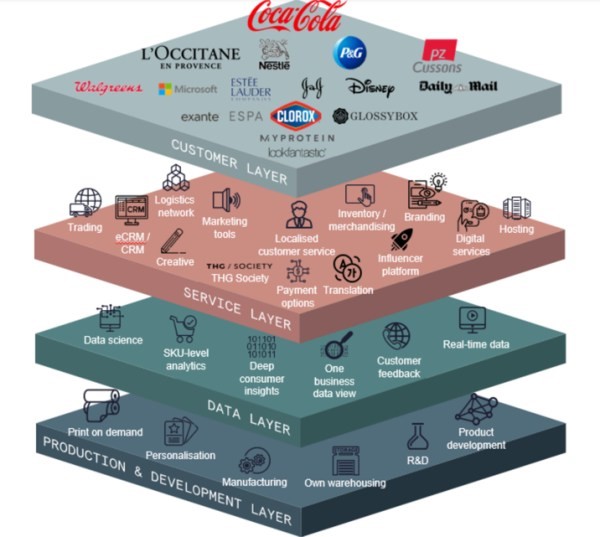

A very interesting proposition, if more suited to larger brands, is the Ingenuity Software Suite sold by The Hut Group (THG). It integrates many of the functionalities I’ve mentioned in one place. THG developed it as part of their own go-to-market model of building D2C brands, which essentially makes it a software package based on a D2C business model blueprint.

(Source: Exciting Commerce)

THG even goes a step further and integrates some production orientated features into the ingenuity suite. It’s based on the four pillars of technology, operations, digital, and data. To date, this is the most comprehensive D2C technology package that I have come across and it will be interesting to see how it further develops.

As there are always new tools worth mentioning, I look forward to hearing more about your favourites in the comments.

Begin with the Consumer and Control Your Brand

Clearly, consumers expect to be able to see and shop your brand via digital channels. Selling direct-to-consumer is here to stay for both, small and large brands. It is critical to think hard and smart about how to best interact with your consumers and maintain control over your brand. The consumer-first mindset combined with the right technology and, as ever, an excellent execution will let you reap the rewards in the future.

About the Author:

Christoph spent 25 years working with brands and retailers in the fashion and sporting goods industries. He is always interested in hearing from people who want to take their business to the next level! Read more of his work here or get in touch with him here.